Hong Kong remains the gold standard for business infrastructure in Asia. With its simple tax regime (capped at 16.5% for corporations), strategic location, and common law legal system, it is the premier gateway for entrepreneurs targeting the Greater Bay Area and international markets.

However, while company formation in Hong Kong is efficient, it is not without its bureaucratic nuances. Whether you are a local entrepreneur or looking into starting a company in Hong Kong as a foreigner, missing a single statutory requirement can lead to delays or banking complications down the line.

This guide covers the end-to-end process, from company registration requirements to the reality of opening a bank account, helping you navigate the system with confidence.

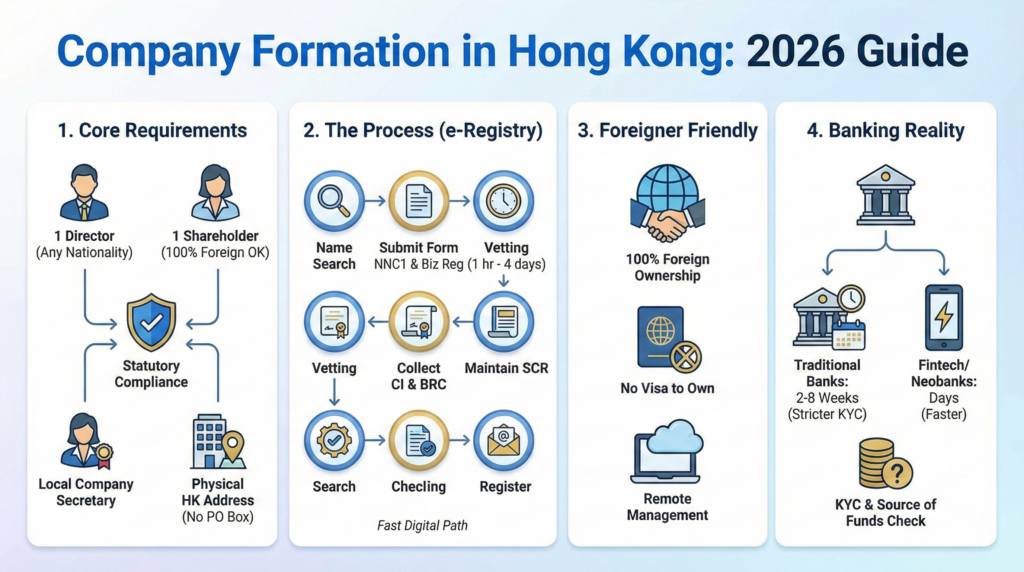

1. The Core Requirements: What You Need Before You Start

Before you file a single document, you must satisfy the statutory structure required by the Companies Registry (CR). The barrier to entry is low, but the requirements are strict.

Company Structure Checklist

- Company Name: Must be unique and not infringe on existing trademarks. You can have an English name, a Chinese name, or both.

- Directors: Minimum one director.

- Must be a natural person (at least one).

- Can be of any nationality and residency (does not need to live in Hong Kong).

- Shareholders: Minimum one shareholder (can be the same person as the director).

- Can be a person or a corporate body.

- 100% foreign ownership is allowed.

- Company Secretary:Mandatory.

- If an individual, they must ordinarily reside in Hong Kong.

- If a corporate body, it must have its registered office or a place of business in Hong Kong.

- Note: Sole directors cannot act as their own Company Secretary.

- Registered Office Address:

- Must be a physical address in Hong Kong.

- PO Boxes are strictly prohibited.

- This address is where government mail (from the Inland Revenue Department) is sent.

Pro Tip: Most modern entrepreneurs and overseas founders use a Virtual Office service (like Coffice) to satisfy the registered address and company secretary requirements simultaneously, ensuring privacy and compliance without leasing physical space.

2. Step-by-Step: How to Open a Company in Hong Kong Online

The days of paper filing are fading. The Companies Registry now favors the e-Registry system, which streamlines the process significantly.

Step 1: Company Name Search

You cannot register a name that is identical to one already appearing in the “Index of Company Names” kept by the Registrar. You can conduct a free search via the Cyber Search Centre to ensure your desired name is available.

Step 2: Submit the Incorporation Form (Form NNC1)

This is the primary document for a private company limited by shares. You will need to provide:

- Company Name.

- Registered Address.

- Director and Shareholder details (Passports/ID copies).

- Company Secretary details.

- Articles of Association: A standard template is usually provided by the e-Registry.

Step 3: Business Registration (Simultaneous Application)

Hong Kong employs a “One-stop Notification” service. When you apply for incorporation, you are automatically applying for the Business Registration Certificate (BRC) from the Inland Revenue Department (IRD). You do not need to file a separate application.

Step 4: Vetting and Approval

- Electronic Application: Can be approved in as little as 1 hour.

- Paper Application: Typically takes 4 working days.

Step 5: Collect Certificates

Once approved, you will receive two digital or physical documents:

- Certificate of Incorporation (CI): Proof of legal existence.

- Business Registration Certificate (BRC): Proof of tax registration.

Step 6: Significant Controllers Register (SCR)

Since 2018, all HK companies must maintain an SCR to identify persons with significant control over the company. This document is not public but must be accessible to law enforcement officers upon demand.

3. Company Formation in Hong Kong Cost

“How much does it cost to set up a company in Hong Kong?” is the most common question. The cost is split into two categories: Government Fees and Professional Fees.

Government Official Fees (Estimates for 2025/2026)

- Company Registration Fee: ~HKD 1,545 (Electronic) to HKD 1,720 (Paper).

- Business Registration Fee (1-year): ~HKD 2,200 (Subject to annual budget waivers).

- Total Government Fees: Approximately HKD 3,745.

Professional Service Fees

If you use a service provider to handle the paperwork, act as your Company Secretary, and provide a Registered Address, fees typically range from HKD 3,000 to HKD 6,000+ on top of government fees, depending on the complexity and service level.

4. Starting a Company in Hong Kong as a Foreigner

Hong Kong is incredibly open to foreign investment.

- No Visa Required: You do not need a visa to own a company. You only need a visa if you intend to move to Hong Kong to work for the company.

- Remote Management: You can operate the business entirely from overseas.

- Tax Efficiency: Hong Kong uses a territorial source principle of taxation. Profits arising in or derived from Hong Kong are taxed (currently 8.25% on the first HKD 2 million, 16.5% on the rest). Profits generated entirely outside Hong Kong may be tax-exempt (subject to an offshore claim).

5. The Challenge: Hong Kong Company Formation with Bank Account

While obtaining the Certificate of Incorporation Hong Kong is fast, opening a traditional bank account is where rigorous “Know Your Customer” (KYC) standards apply.

The Banking Reality

Banks need to verify the source of funds and proof of business.

- Required Documents: Business plan, proof of invoices/contracts, address proof of directors (from their home country), and sometimes a face-to-face interview (though many banks now offer remote video interviews).

- Timeline: Traditional banks (HSBC, Standard Chartered) can take 2 to 8 weeks.

- Alternatives: Many startups opt for “Neobanks” or Fintech platforms (like Airwallex, Statrys, or Currenxie) which can open accounts in days and are fully integrated with HK corporate structures.

People Also Ask

How long does it take to set up a company in HK?

If you submit via the e-Registry app, incorporation can take as little as one hour. However, preparing the documents and KYC usually takes 1-2 days. Paper submissions take roughly 4 working days.

How do I form my own company?

You can do it yourself via the e-Registry portal if you have a local address and a local friend to act as Company Secretary. However, most businesses hire a licensed dedicated service provider to ensure the NNC1 form and SCR are handled correctly to avoid fines.

What are the requirements for company formation in Hong Kong?

You need 1 director, 1 shareholder, a local Company Secretary (individual or body corporate), and a Hong Kong registered office address (non-PO Box).

Hong Kong company registration cost?

Budget around HKD 3,745 for government fees alone. If you need a company secretary and registered address service, a full package usually costs between HKD 5,000 and HKD 8,000.

Why Your Registered Address Matters

Your registered address is more than just a formality; it is your official face to the government and the public. Using a residential address can compromise privacy, and a PO Box is legally rejected.

At Coffice, we provide more than just a workspace. We offer a prestigious commercial address that satisfies all government company registration Hong Kong requirements. Whether you need a dedicated desk, a private office, or a virtual office solution to handle your government mail and secretarial needs, we ensure your business foundation is solid from day one.

Ready to launch your business in Hong Kong?

Explore our Workspace and Virtual Office Solutions to get your company started on the right foot.